We deliver data clarity

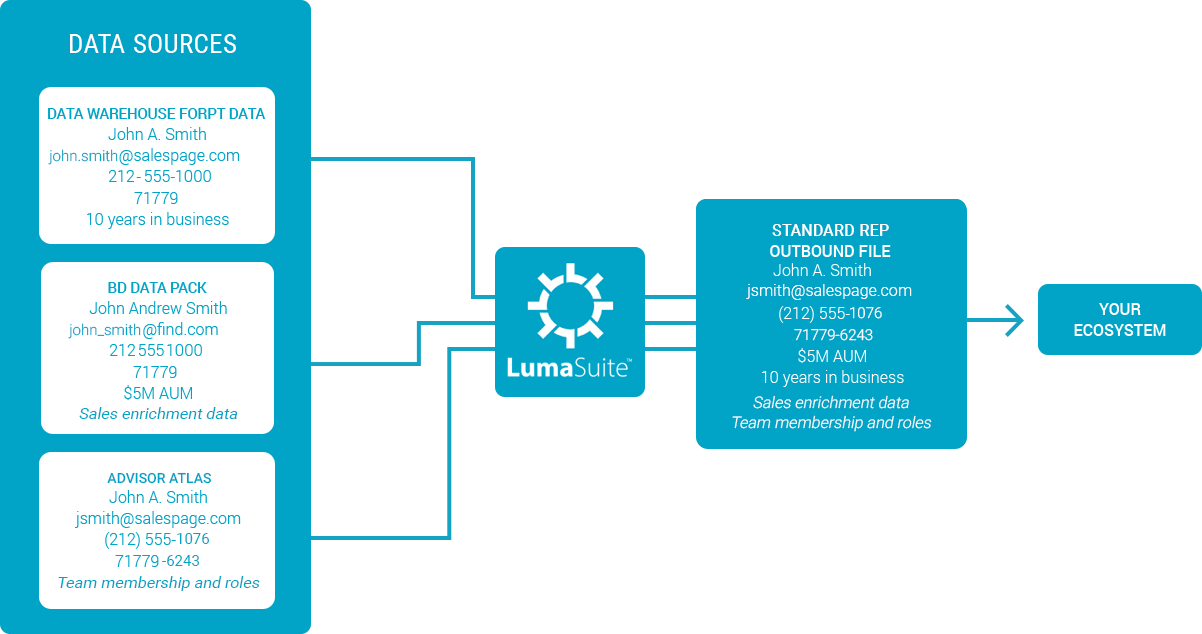

Data is both a challenge and a game-changer. It’s coming from multiple sources and can be difficult to utilize. If your data is consolidated and standardized, analyzing it becomes easier, results are more accurate, and actionable insights can emerge that may drastically impact your team’s success.

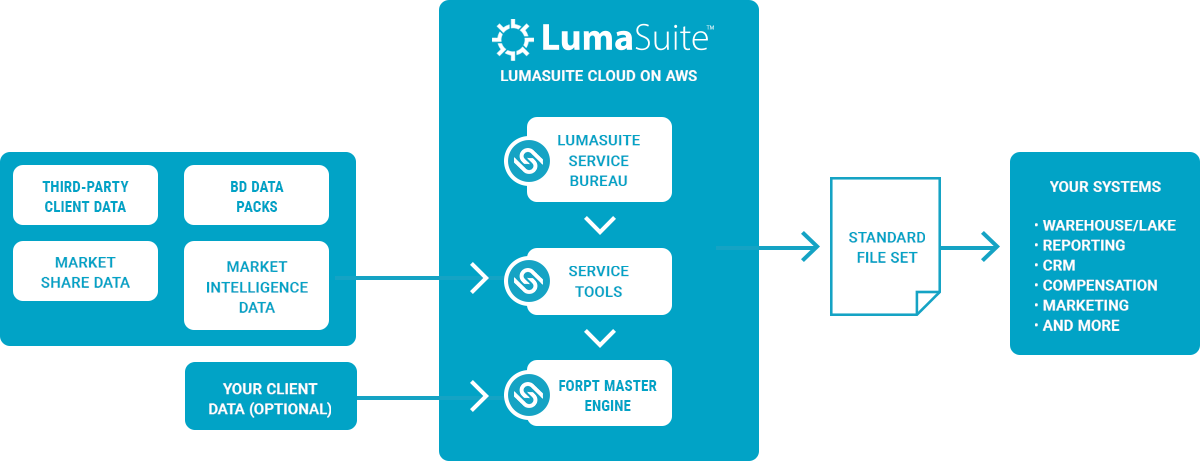

Asset managers now use more third-party data to segment, generate leads, and match products to client and prospect interests. Each third-party source has a unique format and data elements that can change often—especially broker dealer data packs. The effort required to consume disparate data from multiple sources amplifies the cost of third-party data, reduces the benefit, and even deters some asset managers from investing in it.

LumaSuite is a cloud-based solution that helps you ingest and leverage your data more easily and expeditiously. Your third-party sources are processed, standardized into a single data format, and even optionally reconciled securely with your existing FORPT (Firm, Office, Rep, Partnership, Team) data. This standardized data is provided to you as a set of consistent and reliable files that can be consumed by your enterprise systems (such as CRM, marketing, analytics, reporting), data warehouses, or data lakes.